PREA Quarterly Feature - Fall 2022

Tim Coy

Tim CoyDeloitte Services LP

John D'Angelo

John D'AngeloDeloitte Services LP

Two years ago, business environments began transforming following the unfortunate realization that the world’s supply chains were not sufficiently robust to withstand a major shock to the system. Logistics providers, manufacturers, and retailers continue to face decisions on how to reliably get the right amount of product from point A to point B, holding just enough in case of another breakdown. Real estate owners, investors, and operators are balancing the demand for additional space to facilitate more reliable distribution networks with an economic outlook that could again put the world on pause.

Given this backdrop, several reasons justify an optimistic outlook for the industrial real estate sector. Recent legislative incentives and further strategic nearshoring of supply chains for reliability are encouraging greater investment in warehousing, distribution, and manufacturing facilities. Creative solutions such as urban fulfillment centers could bring timely, cost-effective options to large concentrations of consumers. In this article, we further explore demand drivers and dynamics for industrial real estate.

Uncertainties in the Geopolitical Landscape

Even prior to recent global uncertainties, the impacts of geopolitical discourse, shifting consumer spending patterns, and new legislative actions played a part in how businesses shipped goods around the globe. Added now are looming economic concerns of a recession, further weighing on strategic decision-making.

Deloitte’s third-quarter “United States Economic Forecast” outlines the outcome and likelihood of possible economic scenarios (in parentheses) in the US for the years ahead:1

- The Baseline (55%): Economic growth slows but continues through the remainder of 2022. Tighter monetary policy and the impacts of food and energy shortages are concerning. However, pent-up demand for entertainment and travel coupled with improving business investment bolster the near-term outlook. Inflation could settle back to 2% by the end of 2023 as the demand for goods slows and supply chain issues ease.

- The Next Recession (30%): The Fed employs an aggressive tightening strategy to combat inflation. Business investment slows as uncertainties weigh on decision-making. Supply chain issues subside, in large part because of faltering economic conditions.

- Back to the 1970s (15%): Inflationary worries cause wages and prices to increase in lockstep, inducing an inflationary spiral. Inflation stabilizes at 6% as the Federal Reserve avoids a recession, though with tighter monetary policy, economic growth slows.

Even as inflation pressures mount, consumer spending behavior is expected to remain steady but with a shift in preferences. According to Deloitte’s “Global State of the Consumer Tracker” (a survey of consumer preferences over the next four weeks), surveyed consumers are planning for more discretionary spending for services over goods, led by recreation and entertainment, leisure travel, and restaurants and takeout.2 The “Economic Forecast” reports that durable goods spending, already down 6% from peak second-quarter levels last year, will slow as spending patterns “renormalize” from quarantine-era behavior.

Recent US legislation has made way for some optimism, especially for building and investing in domestic production capabilities. The Inflation Reduction Act introduced energy credits and tax deductions for energy-efficient commercial buildings. Passage of the CHIPS Act jump-started investment for semiconductor production, and firms have already put plans into motion for major fabrication plants across the country. Both initiatives can benefit localized development and manufacturing.

The past two years show that shocks to the global supply chain can stop businesses in their tracks: conflicts in Europe and tensions in Asia, extreme weather, and public health emergencies all exposed flaws in just-in-time supply chains. Firms should be aware of changes across the geopolitical landscape and be prepared to balance cost with efficiency and resilience.

The Current State of a Pandemic-Disrupted Supply Chain

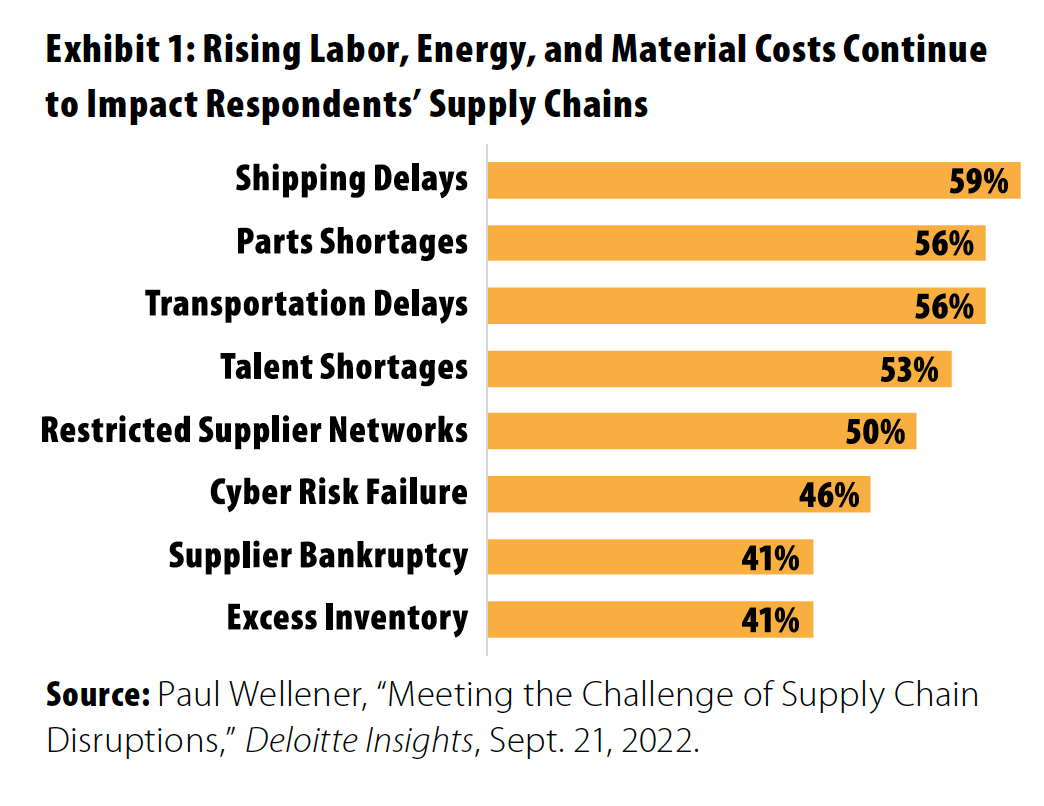

According to Deloitte’s 2022 Manufacturing Supply Chain Study, shipping delays, parts shortages, and transportation delays (truck driver shortages and congested ports) had the greatest impact on manufacturing company supply chains over the past 12 to 18 months (Exhibit 1).

Pandemic-caused disruptions to the just-in-time supply chain model are still being felt. Retailers and manufacturers alike continue to stockpile inventories to meet existing demand and backstop against further interruptions. Total business inventories are growing at the fastest pace on record, increasing for 16 consecutive months, currently at 18% year-over-year growth in July, according to the US Census Bureau. Although strong demand has sustained these inventory increases, consumer spending growth has been positive for 18 consecutive months, and the recent pace of growth and the composition of spending patterns could be shifting.3 Both retailers and manufacturers could face a balancing act: maintaining enough inventory to soften any further vulnerabilities to supply chain disruptions without overextending and holding too much costly inventory.

With uncertainties abounding, firms have identified four mitigation strategies to shore up their logistics platforms: strengthening existing relationships, pursuing multiple and regionally diverse suppliers, implementing digital solutions for greater transparency, and moving away from just-in-time approaches back to just-in-case (Exhibit 2).

What Is the Impact on Real Estate Markets?

With manufacturers ramping up production and record inventories being held, exacerbated by pandemic-era supply chain limitations and consumer spending patterns, demand for warehousing and manufacturing space has grown at a blistering pace. On average, according to Cushman & Wakefield, rents peaked in the third quarter of 2022, topping $8.70 per square foot, for a 22% annual increase, the largest annual increase on record. Despite recent concerns about consumer demand amid economic uncertainty, Prologis estimates that more than 800 million square feet (MMSF) of pent-up incremental demand for industrial space still exists. E-commerce and the need for space have propelled demand growth for industrial product to facilitate online distribution networks. CBRE forecasts suggest e-commerce should continue to gain an additional share of total retail sales over the next decade, topping 33% by 2031.

Although developers have made efforts to keep up with user demand, a record 626 MMSF of industrial construction is underway, notes CBRE, and capacity constraints in cost of land and materials could continue to keep vacancies tight and rents elevated over the near term. Prologis estimates suggest at the current rate of take-up and new development, available space in the US could dry up in 16 months. Driven by necessity during the pandemic, e-commerce saw significant growth, and in the early days of the pandemic, a number of first-time e-commerce customers were minted. According to a global survey, 77% of consumers shopped more frequently online than prior to the pandemic.4 Those consumers expect fast delivery, and fulfillment or delivery time can significantly influence buying behavior. Shopify reported that roughly 58% of consumers stopped buying a brand entirely after one to three shipping delays or disruptions. Of online consumers, 64% expect orders placed by 5 pm to qualify for next-day delivery and 61% expect orders placed by noon to qualify for same-day delivery.5

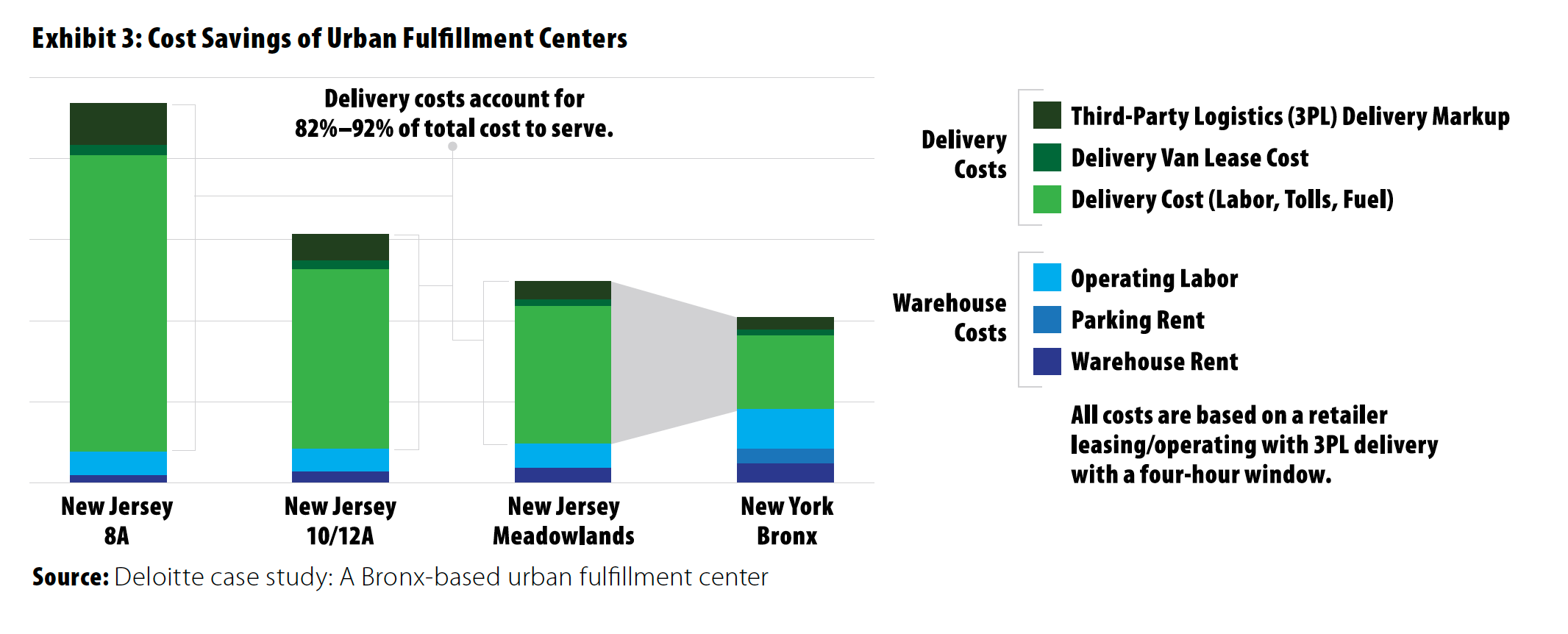

The traditional hub-and-spoke model, with inventory concentrated in a central hub and distribution spokes reaching out, was both efficient and effective, but it no longer meets rapidly changing consumer expectations. One way e-commerce companies are meeting the demand for one-day or near real-time delivery is through urban fulfillment centers, bringing the fulfillment center closer to the end consumer. Although labor and real estate costs typically become more expensive closer to city centers, Deloitte studies indicate that overall “last-mile” cost to serve is less in urban fulfillment centers because of significantly reduced overall delivery cost (labor, tolls, fuel). Though warehouse costs are higher, those costs are more than offset by lower delivery costs (Exhibit 3). Reducing the delivery commitment window provides obvious competitive advantages.

What Is Driving Production Back to the US?

Even before widespread supply chain issues disrupted global manufacturing during the pandemic, reshoring of manufacturing on US soil was already underway. To be sure, supply chain issues that occurred during the pandemic highlighted the fragility of long supply chains and risks inherent in them. Robotic manufacturing and smart factories have changed the dynamics of high labor costs that, in part, drove a multi-decade trend of manufacturing away from the US. Recognizing the benefits of constructing more resilient supply chains and significantly reducing transportation costs, companies significantly accelerated reshoring or nearshoring of manufacturing during the pandemic.

Indeed, according to data from the Reshoring Initiative, in 2021 alone more than 1,800 companies reshored production, setting a record.6 The group further reported that more than 850,000 manufacturing jobs, or over 75% of the 1.3 million jobs that returned to the US since 2010, were moved over the past two years. And Reshoring Initiative estimates that US manufacturers will reshore another 350,000 jobs by the end of 2022, a 31% increase over 2021.

Although manufacturing reshoring is not particular to a single type of product or industry, it is concentrating in facilities that manufacture high-value products with complex manufacturing processes. In particular, it is manifesting in two areas: (1) electric vehicle battery manufacturing and vehicle assembly and (2) semi-conductor manufacturing. The CHIPS Act will likely accelerate the latter, but supply chain challenges with semiconductors and risks related to geopolitical tensions in Asia represent additional significant drivers.

Some examples of just these two categories of manufacturing include the following:

- Of the roughly 77 MMSF of manufacturing facilities under construction or planned since the second half of 2021, nearly 45 MMSF is in EV assembly or battery production (representing nearly 60%), according to JLL.

- Intel has announced a $30 billion partnership to build new semiconductor manufacturing facilities, the first of which is planned for Arizona.

- Samsung is investing $17 billion in a new semiconductor plant in Texas.

- Micron Technology announced plans to invest as much as $100 billion to build a semiconductor manufacturing campus in upstate New York.

As the pace of global integration has slowed or reversed because of several factors, “slowbalisation” appears to prevail. The Economist coined the term in early 2019 to describe the steep decline in globalization, but the pandemic, trade disputes, and the conflict in Europe have exacerbated the trend since the beginning of the new decade. As manufacturers seek supply chain resilience, robotic and smart manufacturing brings down labor costs, and government incentives kick in, the trend of reshoring manufacturing to US soil shows no signs of slowing.

1. Daniel Bachman, “United States Economic Forecast,” Deloitte, Sept. 15, 2022.

2. “Global State of the Consumer Tracker," Deloitte.

3. US Bureau of Economic Analysis, Real Personal Consumption Expenditures, retrieved from FRED, Federal Reserve Bank of St. Louis, Oct. 11, 2022.

4. "COVID-19 Impact on Consumer Behaviour,” Rakuten Insight, May 13, 2022.

5. Curt Bimschleger and Ketul Patel, “Urban Fulfillment Centers: Helping to Deliver on the Expectation of Same-Day Delivery,” Deloitte, May 2019.

6. Harry Moser and Millar Kelley, “Reshoring Initiative 2021 Data Report: Essential Product Industries Drive Job Announcements to Record High,” Reshoring Initiative, April 26, 2022.

Tim Coy is Real Estate Research Manager at the Deloitte Center for Financial Services and John D’Angelo is Managing Director and Real Estate Solutions Leader at Deloitte Services LP.

This article contains general information only and Deloitte is not, by means of this article, rendering accounting, business, financial, investment, legal, tax, or other professional advice or services. This article is not a substitute for such professional advice or services, nor should it be used as a basis for any decision or action that may affect your business. Before making any decision or taking any action that may affect your business, you should consult a qualified professional advisor. Deloitte shall not be responsible for any loss sustained by any person who relies on this article. As used in this document, “Deloitte” means Deloitte Consulting LLP, a subsidiary of Deloitte LLP. Please see www.deloitte.com/us/about for a detailed description of our legal structure. Certain services may not be available to attest clients under the rules and regulations of public accounting.

About PREA

About PREA