PREA Quarterly Departments - Winter 2022

Maria Surina

Maria SurinaCambridge Associates

JT Zerby

JT ZerbyCambridge Associates

As we begin the new year, the hope for a return to pre-pandemic norms has partially faded away with the emergence of new variants, another rise in caseloads, vaccine and mask mandates, and new lockdowns, primarily outside the US. The now two-year battle against COVID-19 has been defined by significant human and economic losses, followed by adaptation, recovery, and positive momentum that was stifled by new setbacks and fresh considerations.

The cycle in capital markets has been no different. Consumer sentiment, investment activity, and asset returns have been whipsawed by ever-changing headlines, with investment professionals left to sift through the chaos and identify compelling opportunities. The question remains, however: if they were successful in finding attractive investment opportunities, would investors be able and willing to commit capital in the same way and at the same rate as before?

Along with the pandemic’s impact on fundraising (particularly across real estate and other real asset classes), emerging and longstanding trends are shifting the landscape. Foremost drivers of these trends are the development of new technologies that have changed the way people live, work, and socialize; the evolution of consumer trends and human behavior that will have a direct and idiosyncratic impact across sectors; and an increased awareness of and rising expectations for the inclusion of factors related to environmental, social, and governance (ESG) and diversity, equity, and inclusion (DEI) issues.

With this backdrop, we at Cambridge Associates are honored to once again prepare the fundraising column of the PREA Quarterly in 2022. As in previous years, supported by our robust database, we will strive to identify and report on a variety of trends in capital-raising by investment managers in the marketplace for institutional real assets. We have been advising endowments, foundations, private clients, pensions, and other large institutional investors on real assets since the 1980s and have seen investor interest and underlying strategies evolve over time. We define “real assets” as infrastructure, real estate, and natural resources, including energy and commodities, mining, agriculture, and timber. Our investment coverage includes funds, coinvestments, secondaries, and separate accounts investing in public and private debt and equity investment vehicles across the risk spectrum. The Cambridge Associates Real Estate, Natural Resources, and Infrastructure database includes nearly 1,900 investment managers representing more than 5,900 funds. In this article, we reflect on how the global COVID-19 pandemic has affected and continues to impact the industry, shaping fundraising strategies, institutional capital flows, and the composition of the GP universe.

A Look Back at 2019

When we wrote our fundraising series in 2019, we made several predictions. Of course, we had no foresight about an impending global pandemic, but interestingly, many of the predictions came true.

In real estate, disciplined use of leverage coupled with lender forgiveness allowed property owners to weather the pandemic crisis better than they did during the global financial crisis. As a result, COVID-19–driven distressed opportunities never fully materialized, even in a hospitality sector that faced particularly brutal operating challenges. The rise of e-commerce was further accelerated over the past two years, pushing industrial rents and sector valuations to historic highs, leaving already-struggling brick-and-mortar retail behind. Demographic-driven real estate, including residential and certain niche sectors, demonstrated resilience throughout the pandemic, and we observed greater fundraising activity for those strategies as a result.

We continue to see pressure on returns moving forward. Interest rates were low in 2019 and continued to decline through 2021; with cap rates falling, property valuations were driven to new highs. The spread between cap rates and US Treasuries, though still wider than in 2007, has narrowed significantly and may continue to do so as the Federal Reserve considers multiple interest rate hikes over the next year. After years of bullish sentiment and high investor activity, a more-expensive lending environment and ample remaining dry powder are likely to put downward pressure on returns.

A similar trend is in motion in infrastructure. The pandemic heightened attention to tech-enabled and sustainable solutions, which boosted fundraising and increased competition within the investment landscape for managers that saw record asset values across the industry/asset class. Conversely, these same factors were an obstacle to fundraising in natural resources as traditional upstream energy managers continued to face significant headwinds derived from commodity price volatility and fossil fuel divestment. Though some managers will seek to appeal to contrarian investors and execute on distress by purchasing assets at heavily discounted prices relative to existing cash flow, many will struggle to maintain their franchises behind a substantially smaller pool of non-divesting LPs.

COVID-19 Dip and Recovery

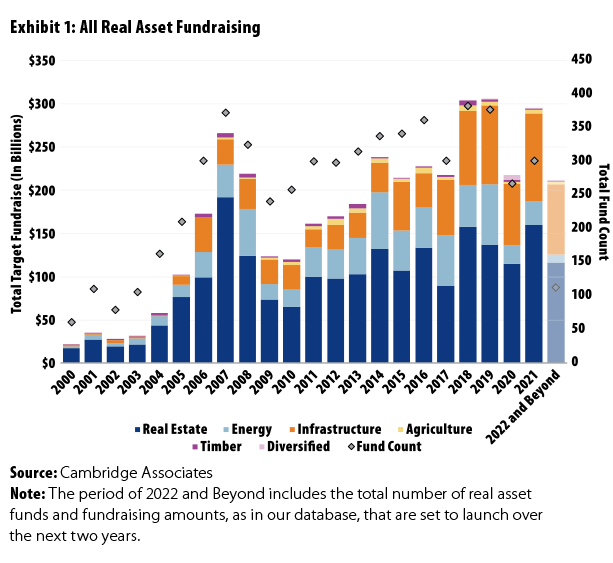

Calendar year 2020 brought a clear and acute disruption in real asset fundraising: neither the number of funds launched nor the total dollars targeted matched record figures reported in the previous two years. In fact, the estimated 270 funds raised was the lowest such figure of the preceding decade, and although the roughly $220 billion targeted was relatively in line with what we observed in the middle of the decade, it still represented a nearly 30% drop from the year before, as shown in Exhibit 1.

The slowdown in 2020 was largely a first-half phenomenon, as business, investment, and fundraising activity all resumed later in the year, with many managers coming back to market. In many cases, managers resumed with the latest iteration of their legacy strategies looking to take advantage of COVID-19–specific distress and noncyclical demand drivers. Full of significant market disruption and uncertainty, 2020 had a predictable, albeit surprisingly short-lived cooling effect on an otherwise hot fundraising cycle. The result was a strong recovery in 2021, with larger firms and fewer funds driving the total fundraising target to almost $300 billion, a near full recovery to pre-pandemic levels.

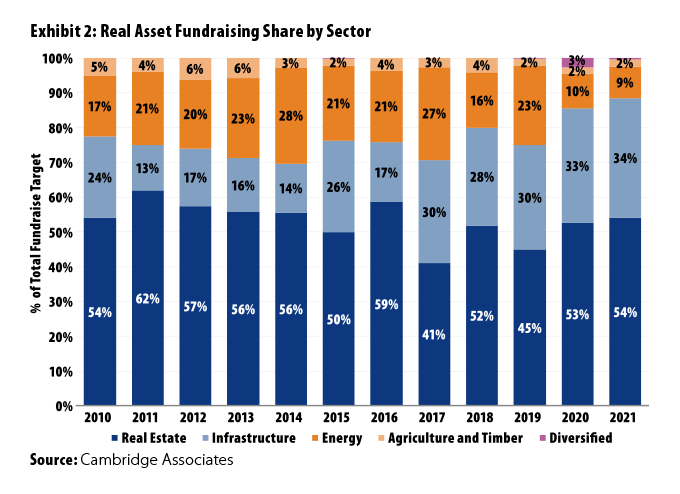

Besides COVID-19–related shocks, additional trends unique to each real asset subsector are reflected in their specific fundraising data; these themes will be discussed in detail later in this article and later in our series. On one end of the spectrum is infrastructure, which experienced a 22% dip in capital raised in 2020 and rebounded in a record fundraising year in 2021 (10% above the previous peak), driven by investor interest in digital and renewable assets. Real estate, which had the smallest drop in 2020 at just 16%, likewise set a record in 2021, though only marginally. As shown in Exhibit 2, sticking out as the biggest loser was traditional energy—inclusive of upstream, midstream, service, and mining managers—where 2020 fundraising plummeted almost 70% and for which our current 2021 estimates reflect only a modest recovery to a level still 60% below the 2019 figure. Private equity energy managers had already experienced years of declining investor interest because of disappointing returns, excess volatility, and increasingly negative sentiment among institutional investors toward fossil fuels. In 2020, commodity and asset prices were decimated—at least temporarily—and climate-driven societal pushback severely hampered remaining institutional interest.

Real Estate Maintains Its Lead

Closed-end real estate continued to dominate the market as the premier hard asset class in 2021. These funds composed 54%, or roughly $160 billion in targeted capital, and 65% of funds raised. Both share figures represent the largest of the past five years, though still well below the pre-2010-decade averages of about 70% and 72%, respectively.

Several factors likely drove real estate interest in 2021. The sector continued to offer solid diversification benefits in a time when other risk assets became more expensive. It boasted superior yield spreads as federal intervention drove interest rates to record lows during the pandemic. Inflation concerns alongside rent growth within COVID-19 winners such as industrial and multifamily residential have shown little signs of abating, attracting investor interest. That said, 2021 fundraising figures are likely elevated because they include managers that paused or delayed funding for vehicles that would otherwise have fallen into the 2019 and 2020 vintages in a more normal environment.

Mega Funds Dictate Market Momentum

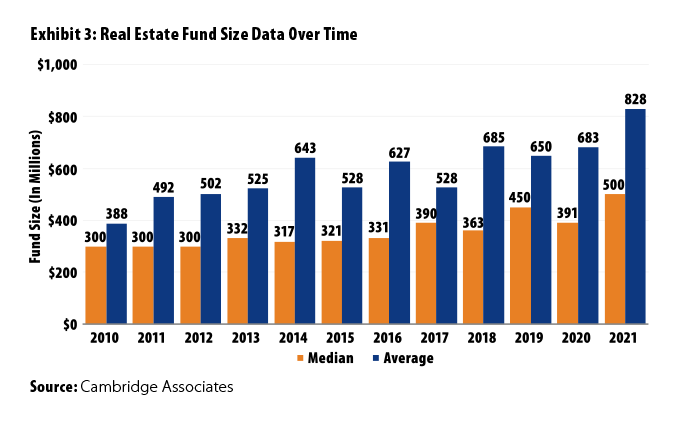

A clear and important element of the real estate data is the continued dominance of mega funds and the dynamic that has arisen over the past two years as a result. As shown in Exhibit 3, average fund sizes have continued to grow, but a lagging median indicates that a small number of larger funds have experienced accelerated growth relative to the field.

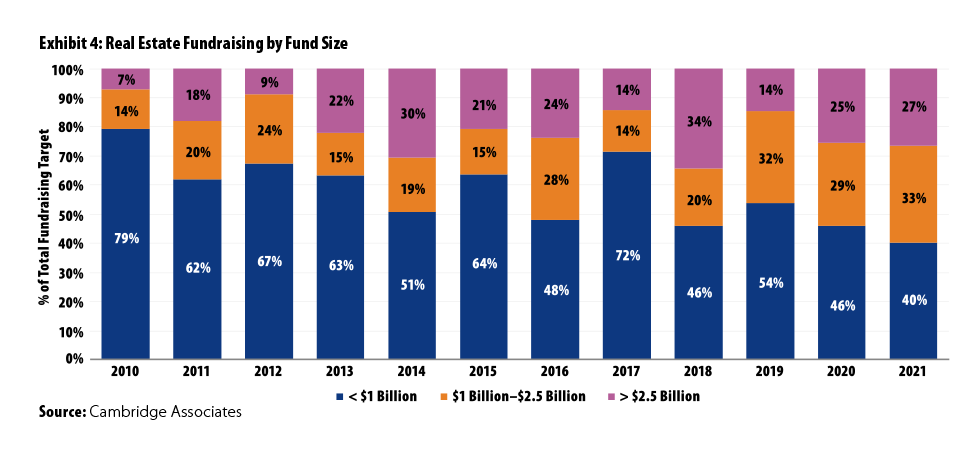

Exhibit 4 shows that the percentage of total capital targeted by larger funds has also grown over time. Limited ability to travel, desktop due diligences, and virtual “on-sites” forced investors to navigate toward established, familiar names, supporting re-ups instead of new commitments; additional scrutiny imposed on emerging managers made their fundraising more challenging than ever. Undoubtedly, larger managers that launched funds were central drivers of fundraising momentum during the pandemic.

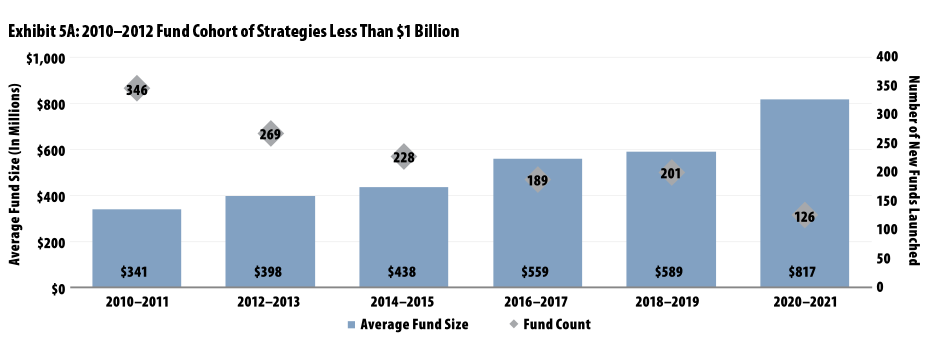

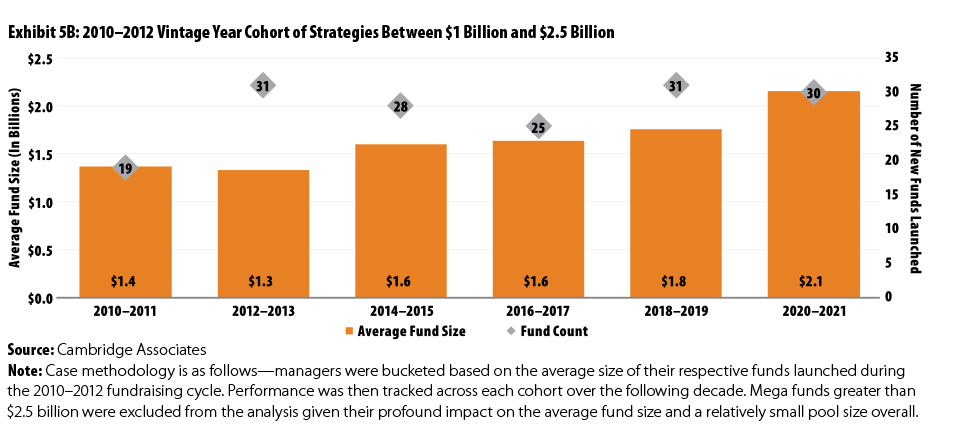

A potential reason for the trends noted is that larger managers (and their established large teams) felt more confident in their ability to raise capital during a period of investor anxiety. Historical data suggest this is a reasonable presumption. As shown in Exhibits 5A and 5B, we ran a case study to better understand fundraising behavior for real estate managers of various sizes. The findings were clear: managers that continued to operate were typically able to grow fund sizes; small managers had a weaker survival rate—evidenced by the declining number of funds launched by that cohort relative to the consistent number launched by the large-fund cohort. This survivorship bias also inflated average fund size data. Taking this into account, it is unsurprising that larger managers, able to increase the size and pace of their product offerings, dominated the market over the past two years.

Emerging and Diverse Managers Take Center Stage

As noted, large managers have played an increasingly dominant role in fundraising across Cambridge Associates’ real asset universe. Through the pandemic’s disruption of portfolios, investment pacing, and fundraising plans, this trend will likely only become more pronounced as smaller, emerging managers struggle to attract capital versus established managers. Given this history, one question we ask is where does that leave diverse managers that are typically developing their businesses and brands? As of 2017, majority diverse-owned firms in the US represented only 0.9% of total assets under management (AUM) despite the non-white demographic totaling nearly 50% of the population. Understanding the fundraising bias toward large asset managers that are overwhelmingly nondiverse, proactively allocating capital to these smaller diverse managers is as critical as ever to bridge the opportunity gap that exists in the asset management industry. Fortunately, increasing opportunities abound.

At Cambridge Associates, we describe diverse managers as those that meet a 33% hurdle of diverse or women representation in a firm’s ownership, which represents what we as a firm believe to be circumstances where those diverse individuals experience a higher level of comfort and individuality, increased support from—and collaboration with—peers, and noticeable and achievable impact on firm content and behavior. Currently, we track more than 850 diverse managers and more than 2,300 of their funds across all private asset classes. Specific to real estate, we observe that the number of diverse- or women-owned real estate fund launches approximately doubled since 2015 compared to the previous five years.

Historically, emerging managers on the whole have represented a large portion of the top-performing real estate funds across vintages. For diverse managers, the story is no different, as many have generated strong performance. However, diverse managers typically fall into the smallest manager cohort based on AUM, which typically has the greatest dispersion in performance. Manager selection therefore remains critical.

Similar Times Ahead?

As we look across the next fundraising cycle, we anticipate capital-raising activity across real assets to moderate as smaller managers struggle to meet fundraising goals and larger managers that are more successful in securing commitments have substantial dry powder that will be invested in a tighter market, delaying target investment paces. Finding relative value will remain a challenge in the environment of stretched valuations and substantial liquidity. We expect interest rates to rise gradually in 2022, impacting valuations and tempering returns. Although new funds will undoubtedly continue to populate our database as the year progresses, we see an overall decline in the total number of funds set to launch over the next two years.

In real estate, years of high valuations and low interest rates have led to rapid deployment of capital and shortened investment periods, with managers fundraising every two years or thereabouts instead of the typical three-year cycle and targeting larger vehicles every time. To maintain asset allocation targets, limited partners will continue to have to choose between re-upping with fewer high-conviction names or making smaller fund commitments to a more-diversified pool of managers. Increasing manager concentration is an option but comes with risks in a shorter fundraising cycle because with each cycle, LPs have a less-seasoned portfolio to evaluate.

With increasing competition for capital, we expect to see continued growth in niche and property-specific strategies as investors look for more targeted exposures in their real estate allocations. Beyond cyclical beneficiaries in industrial and residential, health-care real estate, including medical office and life science, has been a pandemic-era “winner,” thanks to accelerated funding of the health-care industry, continued innovation, and aging demographics. Exponential data growth from a rapid increase in device usage, digitized businesses, and continuous technology innovation has accelerated the need to store, process, and interconnect data—fueling demand for data centers. Digital infrastructure overall, including data centers and cell towers, will likely be strategies of choice, and this is where we see blurring of the lines between real estate and infrastructure funds.

Not surprisingly, infrastructure looks set to continue making gains on real estate, representing a record 38% ($80 billion) of the total capital targeted in the next two years. A near majority of private infrastructure investment is focused on the digital and renewable spaces. Over the past several years, we have observed precipitous fundraising and investment activity in more-traditional assets such as cell towers, fiber, and wind and solar power generation, which has inflated valuations, particularly in auctioned and marketed sales processes. In search of higher return opportunities, institutional investor interest has spiked in less-proven strategies across hydrogen energy, offshore wind, and new decarbonization tools in higher-risk emerging markets. We anticipate that investors will continue to commit greater amounts of capital to the asset class in 2022 and beyond.

Conversely, natural resources may continue its fall from grace to less than 5% ($10 billion) of the target as oil and gas managers continue to struggle. For those investors willing and able to invest in upstream, years of underinvestment, a fractured ownership profile, and strong pricing fundamentals from both the supply and demand side have created a value opportunity in the sector, with assets being priced at large discounts relative to in-place cash flows.

Wrap Up

The past three years of fundraising across real assets have been different from any prior period observed. The pandemic was unlike anything experienced in modern history, and as we continue to move through a full fundraising cycle, the ultimate impact and outcomes are only just now beginning to reveal themselves in full. We hope that throughout 2022, we will continue to see solid economic growth, a rise in vaccination rates worldwide, and an overall return to stability. Disruption is inevitable, but as the world learns to live with COVID-19, we hope to see less volatility overall.

Continued technological disruption, rising awareness of environmental sustainability, diversity, and the need for housing affordability are among the trends that have a direct impact on real assets. Many investors consider these issues and risks of the greatest importance, bringing real assets back into focus with renewed interest, if not commitments. Over the course of our remaining fundraising series for the PREA Quarterly, we are eager to unveil deeper insights into those trends and the real estate industry specifically. Let 2022 be the year of recovery and positive change.

Maria Surina is Senior Director, Real Assets Investment Group, and JT Zerby is an Associate, Real Assets Investment Group, at Cambridge Associates.

This article has been prepared solely for informational purposes and is not to be construed as investment advice or an offer or a solicitation for the purchase or sale of any financial instrument, property, or investment. It is not intended to provide, and should not be relied on for, tax, legal, or accounting advice. The information contained herein reflects the views of the author(s) at the time the article was prepared and will not be updated or otherwise revised to reflect information that subsequently becomes available or circumstances existing or changes occurring after the date the article was prepared.

About PREA

About PREA